Does this sound familiar?

You tell yourself over and over again that you'll start figuring out this money thing... someday.

Someday when you make more money…

Someday when you have a partner who can do it for you…

Someday when you have the time…

But that someday hasn't come yet, has it?

You keep pushing it off.

More important things just keep getting in the way.

You tell yourself you don't have the time..

It's too complicated anyway...

Maybe you’re just one of those people who is BAD with money, right?

And plus, it feels too stressful, too overwhelming, too… big.

So down the road the can gets kicked.

Imagine...

Imagine living your best life, whatever that is– traveling the world, taking a sabbatical, buying that house, having time to pursue your passions– all without ever having to worry about if you have enough in your bank account to make it happen.

Imagine the peace, power and freedom you feel knowing that you’ve got all your bills paid, a fully funded emergency fund, and automated investments working hard so someday you can quit for good.

Imagine feeling so financially confident that you can take a break from working or tell that toxic job to screw off because you’ve got that FU money saved.

Feels pretty good, right?

I'm in.

Listen, I get it. It's not your fault.

We're all busy and it’s not like any of us were ever taught how to money, right?

Not only that, but there’s a thousand gurus out there telling you that the only way to get ahead is to eat rice and beans, avoid credit cards, never travel and skip the cold brew.

Gross.

I mean, if that’s money management at its finest? Who wants it??

What we want is something that’s easy.

That actually works.

And doesn’t make us feel like crap for treating ourselves along the way.

This is why I created The Lazy Money Master Bootcamp

You've seen other money management bootcamps...

and something doesn't feel quite right.

I mean… do you really need to stop going out for your daily coffee? Do you really need to spend time in complicated apps to track every dollar?

That sh*t sounds boring at best, and downright miserable at worst.

I'm ready for something different.You need a system that works for you...

not the system that worked for your Grandpa (no offense).

Because you understand that extreme restriction, not addressing the reasons behind why we do what we do, and a one-size fits all approach… doesn’t work.

Let's do this.

I know how scary it can be...

to realize that no one is coming to save you. Not our government, not a prince in shining armor, not a hefty inheritance (that I know of).

I had to come to several of those realizations in my own life:

- Realizing it was up to me to get out of $70k of debt

- Realizing it was up to me to get out of a financially draining relationship

- Realizing it was up to me, and only me, to prepare for my future

- Realizing no one was coming to save me

Let's do this.

You have to be your own savior.

And the best way to ensure that is to get ourselves financially fit.

So... you ready to do this for yourself?

If you're finally ready to...

1

Secure your own future and feel at peace with your finances

2

Stop stressing about money and questioning your financial decisions.

3

Stop feeling like you work so HARD but have nothing to show for it at the end of the month

4

Overcome the mental blocks holding you back from mastering your money

...without feeling like you need to eat rice and beans for dinner every night...

Then it's time to become a Lazy Money Master.

Become a Lazy Money Master

The Lazy Money Master Bootcamp will take you from…

- Feeling overwhelmed with your finances with no real plan to get out– to feeling confident that you’ve got the right system in place.

- Feeling trapped in your situation to feeling at peace, knowing the exact moves you need to make to become financially free.

- Feeling helpless and like you just aren’t the type of person who can “be good with money” to realizing that money is just a tool, and all you ever needed was someone to teach you the skills in order to get a system in place.

Meet Your Coach:

Hey, Fam. I’m Chloé, but you can call me Clo.

I took my net worth from negative $70k to $400k+ in about five years.

And let me tell you-- when I started? I had NO idea what I was doing in the budgeting space or the investing space, but I knew I had to try.

JOIN NOW

At the time, I believed a lot of the same things you might believe now...

That I was just the type of person who was bad with money.

That I couldn’t figure this stuff out because I didn’t have enough willpower or enough money or <insert any objection here>.

That maybe the answer to my financial woes was just to find a partner who could handle it all for me!

Well, let me tell you how that went.

Let's do this.

I ended up in some bad situations... with some bad people.

Abusive relationships where I had to continue to live with someone after we broke up because I had no money to leave.

Letting an ex rack up $15k of credit card debt to help him out.

Investing my entire life savings in an ex’s business only for him to lose it to bankruptcy years later.

It took me years to get to the point where I was tired of my own shit.

But when I finally decided to change?

I never looked back.

And since that fateful moment in October 2018 where I decided-- Chloé?! Dumber people than you have done this before-- I have not only completely transformed my finances and life, but I've also helped thousand of people do the same.

But here's the thing... I'm not special.

What I did wasn't complicated.

It wasn't extreme.

And it worked despite nothing I had tried working before.

Which is why? I teach now.

In the last two years, I've coached thousands on how to transform their relationship with money, from anxiously avoiding their money...

...to feeling like absolute money masters.

My goal as your coach is to get you to fire me.

Why?

Because I want you to feel capable and confident in managing your own money-- without me.

Because you are capable.

Because the best person for the job?

It's not your financial advisor, it's not your mom, it's not your partner...

...It's you.

Featured On

Introducing

The Lazy Money Master Bootcamp

A 6-week, self-paced program to master your money

Module #1

Money Mindset Reset

Get ready for some money therapy! Learn how to address your limiting beliefs, blueprint your Wealthy Era, and use my Simplify & Thrive Method to make achieving your financial goals as easy as 1, 2, 3.

Module #2

The Money Matchmaker

Let's help you understand your data so that you can learn how to prioritize your competing goals. By the end of this module-- you'll be able to answer questions like-- should I be saving an emergency fund or paying off my debt? Should I save for a house or save for my retirement??

Module #3

The B* Word

Listen-- you're not bad with money, you just haven't found the right system yet. In this module-- I'm going to teach you how to create a CustomFit budget that's uniquely designed for YOU-- and it'll be so easy? You'll wish you had found this method ages ago.

Module #4

Dump the Debt

Got debt and feel like it’s holding you back from literally everything? Not sure what the BEST way to pay it off is?

I got you covered in this Dump the Debt module where you’re going to learn the best way for you to get rid of the debt using my Lazy Debt Busting strategies.

Module #5

Slay your Score

Did you know improving your credit score could save your THOUSANDS every year? Well-- in this module we'll demystify this special score so you can pay off your debt faster than you ever dreamed possible.

Module #6

Chill & Build

Now, let’s make this lazy so you actually stick to the plan! We're diving into automation, lazy hacks, and how to troubleshoot now and in the future so your plan always works for you.

And just like that...

With six sessions of jam-packed info, we are off to the races in 6 weeks.

But of course... that's not all.

Let's do this!

“Learning about budgeting from Chloe is like sitting down with an extremely knowledgeable friend, except minus the fear of that friend judging you for struggling with money.”‘

- Meaghan,"I Can't Budget" Student

“She is upbeat, non-judgmental and very knowledgeable. She made me feel inspired and hopeful about my current and future financial situation.”

- Katrina,"I Can't Budget" Student

“Not only do I want her to help me with my finances, but I want to be her friend.”

-"I Can't Budget" Student

"Working with Clo Bare has helped me so much!! Before attending sessions with her I didn't have a budget, so I had no clue what was coming in or going out and I was honestly terrified to look.

And now that we've been working together, I'm no longer afraid, I've started saving (YAY!) and I understand the trade-offs I need to make to have the life I want.

She's straightforward and realistic while being fun and kind and she holds your hand just when you need it.

I have literally referred everyone I know to her because working with her has changed my life so much. So happy I found her."

-Pia, 1:1 Coaching Client

“For the first time in a long time, I didn’t feel anxious talking about money, because I knew that for once, I was talking with someone who understood the struggle, and who would give education and tips without judgment.”

-1:1 Coaching Client

"Working with Clo Bare gave me the custom knowledge and coaching I needed to further my financial knowledge and behavior. Together we were able to tap into the psychological factors and design an ironclad budget that led to meeting not one but two major financial goals three months ahead of schedule!"

-Kaeisha, 1:1 Coaching Client

Limited Time Only Bonuses

BONUS #1: Wealthy Love, Rich Relationship ($199 value)

Not sure how this applies to you if you're managing money with a partner?

Or dealing with getting your partner on board?

I've got you covered with my EXCLUSIVE relationships bundle where you'll learn from my love coach, and relationship and marriage therapists, Decoding Couples.

NOT SOLD ANYWHERE ELSE.

BONUS #2: How to Stop Impulse Spending ($149 value)

Do you struggle with impulse spending or emotional buys?

I did too! I had to learn how to manage my money and my mental health.

As a recovered impulse buyer and emotional spender, with more than 10 years of therapy under her belt-- in this bonus I share the strategies that helped me manage my money even when my mental health wasn't at its best.

NOT SOLD ANYWHERE ELSE.

BONUS #3: 99 Ways to Use ChatGPT to Get Good with Money ($37 value)

I want to make managing your money as easy as possible for you-- so why not use some AI tools to help get you the results you want-- faster?

When you sign up tonight-- you'll also get an extra bonus guide all about how to use ChatGPT to get good with money.

NOT SOLD ANYWHERE ELSE.

BONUS #4 TONIGHT ONLY: 3 months access to The Lazy Community ($995 value)

You need someone in your corner who you can ask questions and get help and feedback on your unique situation.

Having access to someone who has been in your shoes is going to skyrocket you on your path to financial wellness.

When you sign up tonight-- you'll get 3 months of access to this private community with VIP access to me-- for free.

NOT SOLD ANYWHERE ELSE.

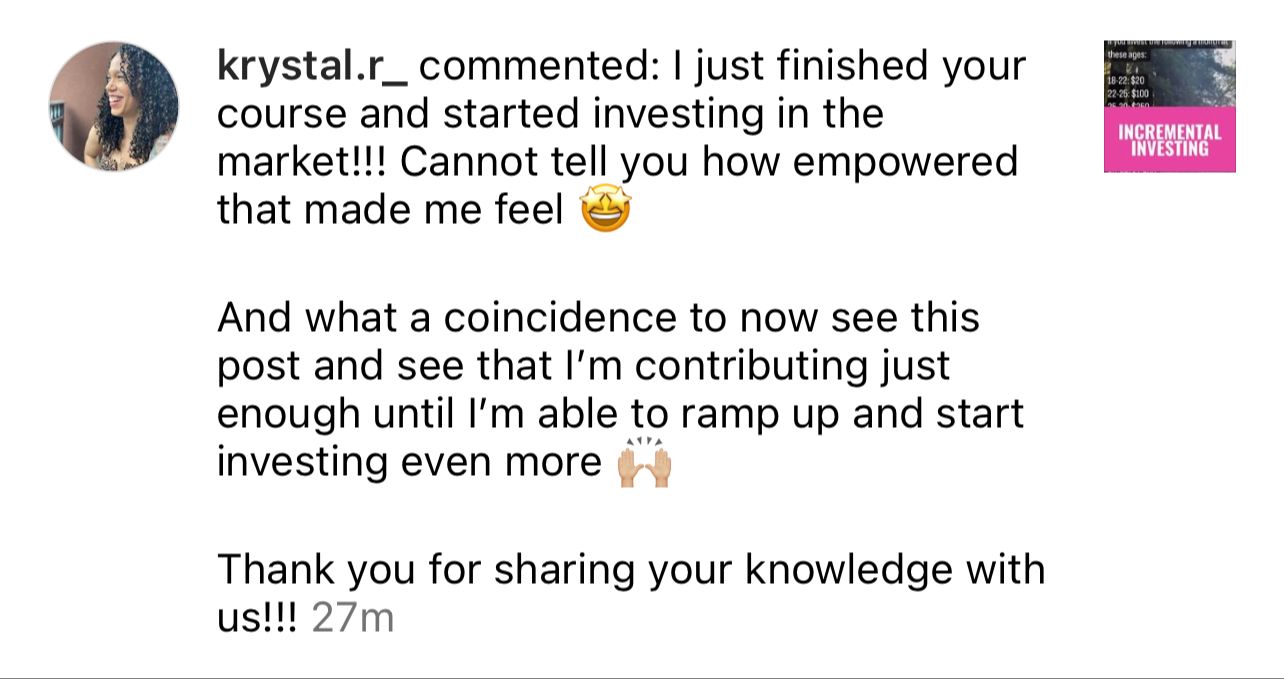

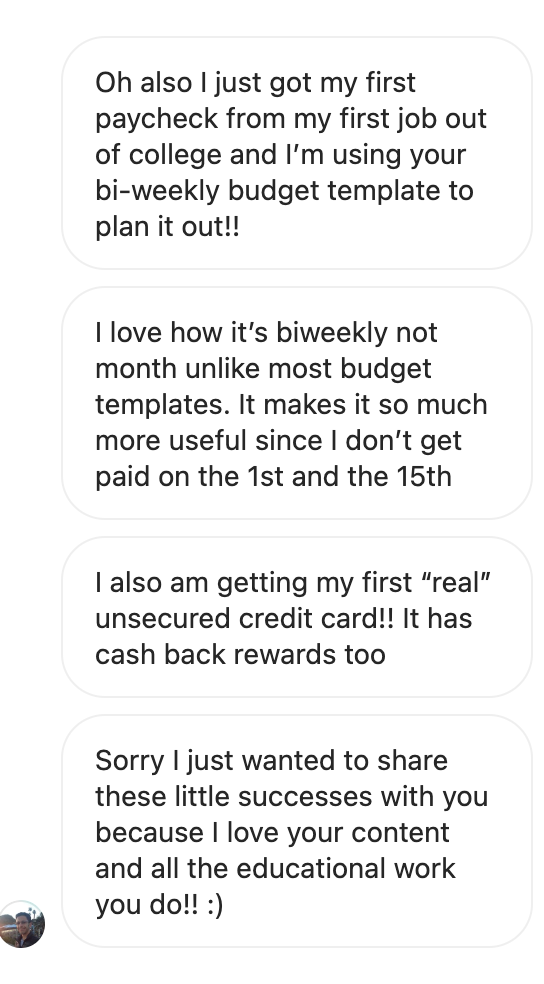

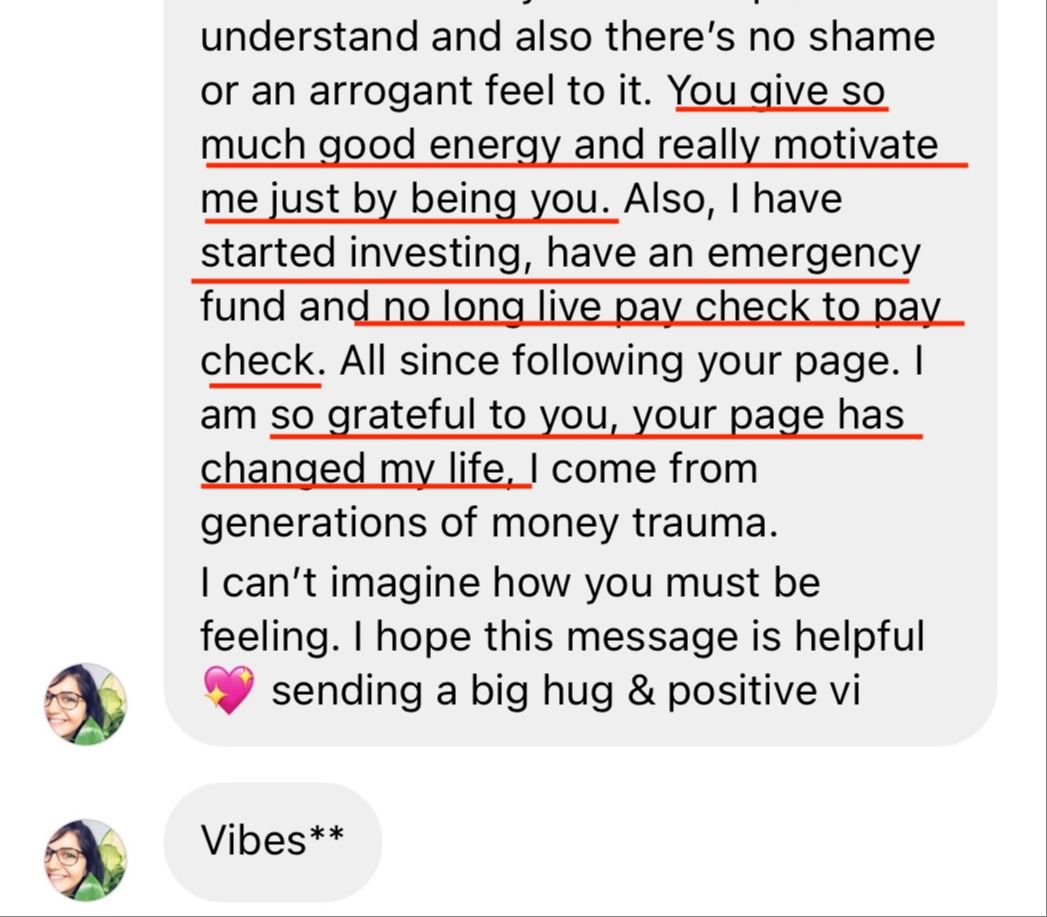

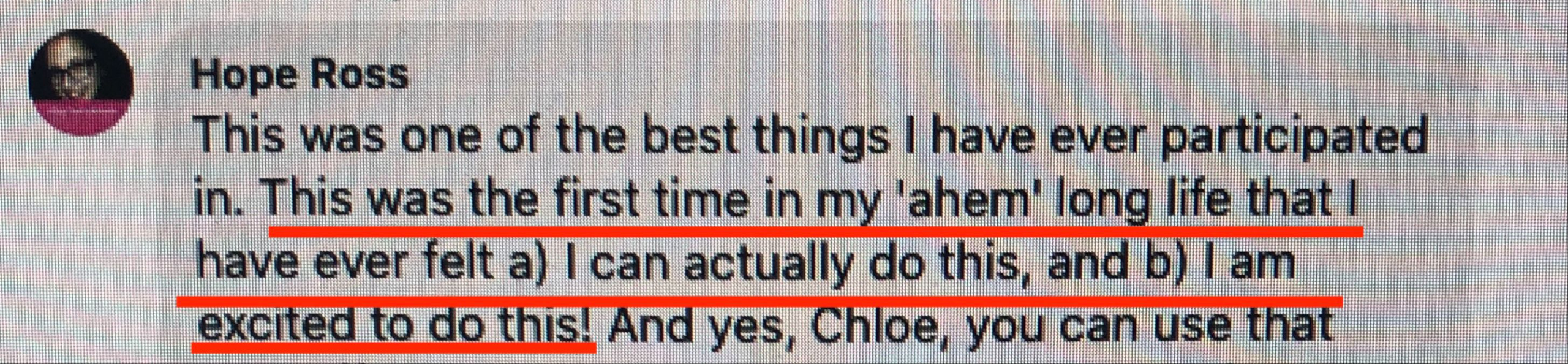

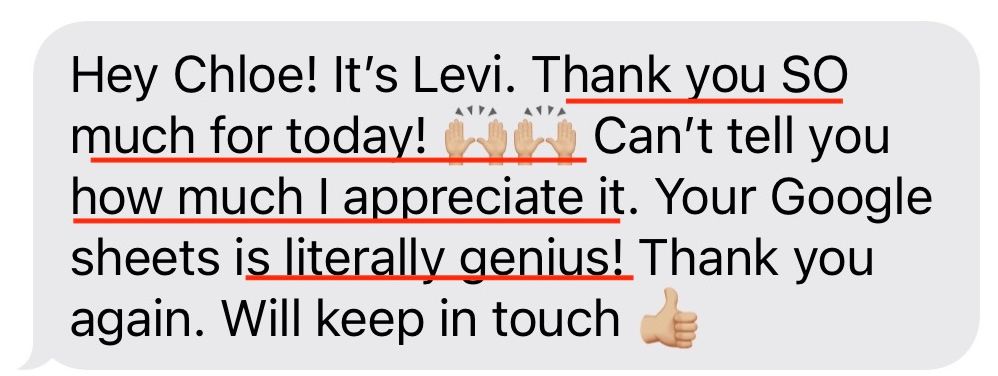

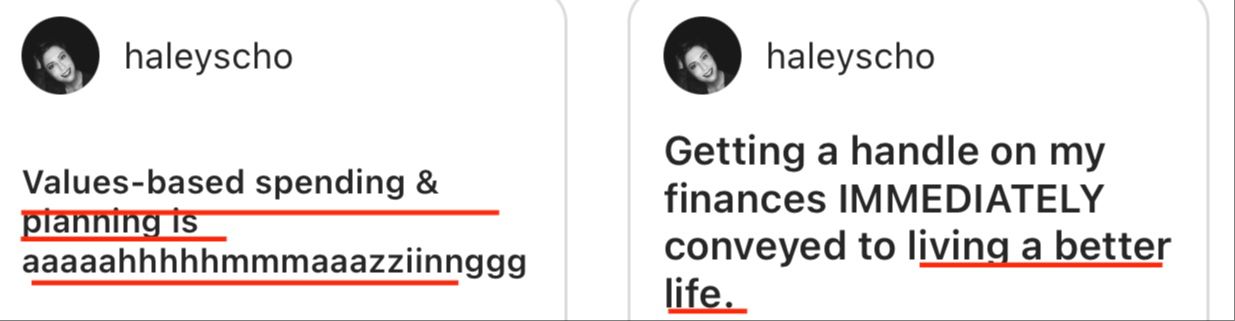

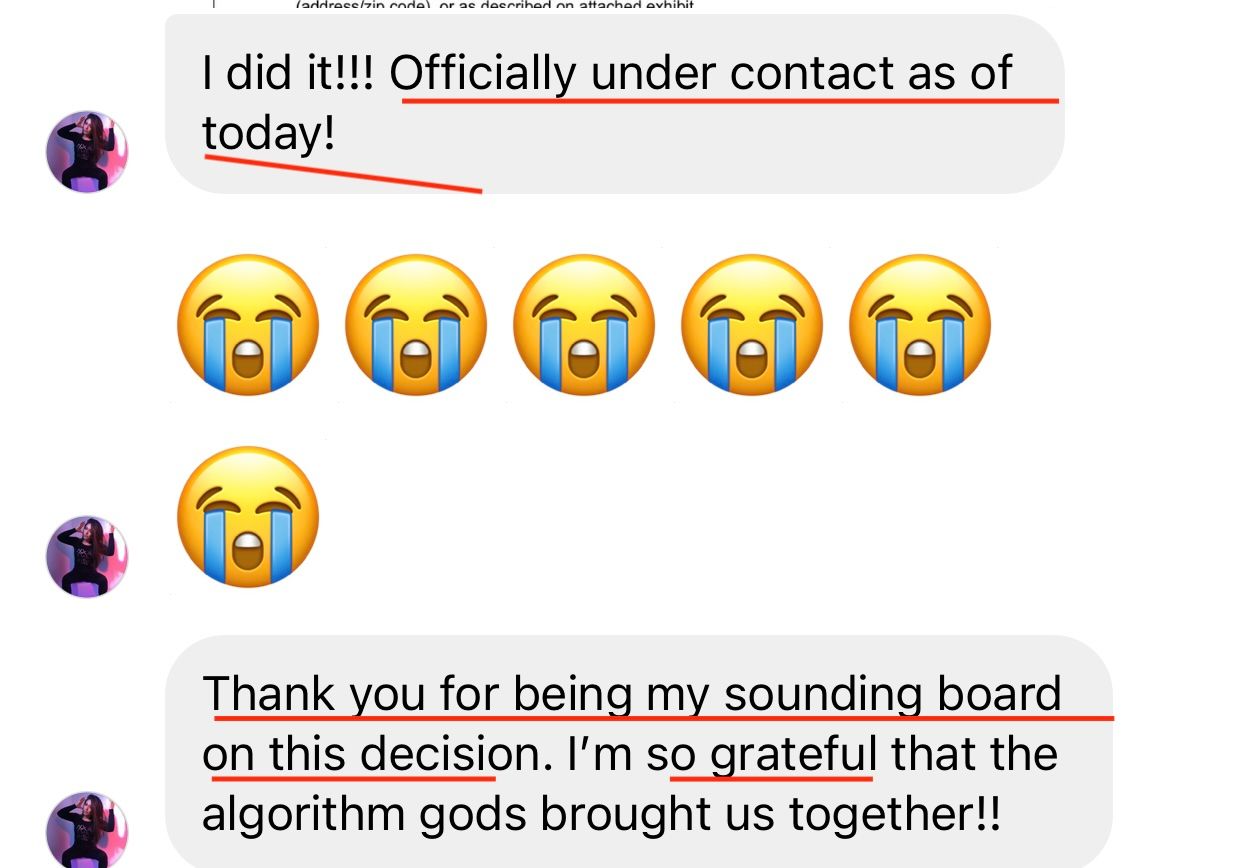

Praise from our Lazy Community

What is holding you back?

Made it this far and still have reservations?

Let's talk about it.

This is expensive… should I really be investing in something like this when I’m not good with money?

I don't have time to do this.

I’ve tried everything before! How do I know this will work???

"Clo Bare introduced me to 'values based spending and savings' and raised my awareness around my money story.

While I've always been aware of my 'money story', I didn't realize how it was holding me back. Similarly, in other areas of my life, I've always known that by identifying my WHY, I'm so much more inclined to follow through and for whatever reason, I had never thought about this with budgeting before.

After this, I feel like I finally have the tools, mindset and strategy to help me feel 'in control' of my money and know that it's ok to spend because I've already saved and accounted for everything else. I'd strongly recommend Clo Bare to any women's groups who are trying to empower themselves with becoming more 'dangerous' with budgeting, investing, and personal finance.

Thank you so much, Clo Bare!"

--Workshop Attendee

"For months I had been trying to get a grip of my budget-- I was keeping track of my spending, seeing where I could cut corners, but it just wasn't working for me.

I felt like I was barely keeping my head above water, and then BOOM-- Chloe came into my life like a life raft.

She led me through the process to show me where my snags are, how I can actually achieve the lifestyle I want to have as long as I am staying in line with what I truly value in life, all in a very easily accessible and straightforward way.

I'm getting paid this week and I CANNOT WAIT to start budgeting in my new values-based budget like Chloe outlined. I guess I'm the kind of person who gets excited about budgets now?! Financial coaching with Clo Bare-- cannot recommend it enough."

--Sophie Banks, 1:1 Coaching Client

"I've met with other folks before who help people to better manage their personal finances but Chloe is the most down-to-earth and approachable one I've worked with so far.

Her transparency and honesty around her process was refreshing and made everything feel that much more attainable (who else actually posts their monthly budget forecast and actual spending for the public to view and learn from?).

It was fun (budgeting can be fun!), entertaining, REAL and Iearned so much from the process. Also, SUPER amazing value for how much I spent. I am walking away from this feeling empowered and excited to start my own journey of making my money work for me."

--Workshop Attendee

Is the Lazy Money Master Bootcamp right for you?

This bootcamp is for you if:

- You are tired of feeling like you’re getting nowhere with your finances, feeling overwhelmed, and you are ready to do what it takes to change.

- You appreciate a goofball of a teacher who likes making complicated and boring topics fun and easy to understand

- You are serious this time. You are amped to make a difference in your own life through a money management system that works for you.

This bootcamp is not for you if:

- You want a get rich quick solution.

- You expect me to do the hard work for you.

- You want someone to manage your money for you.

My goal?

Is to give you the education, tools, and resources you need to manage your money like a master– without me, or anyone else.

But what happens if you wait?

Still not convinced?

What happens if you wait a little bit longer.

Let’s fast forward five years out.

During that time you joined the Lazy Money Masters Bootcamp, got a plan in place to start making money work for you.

After five years of sticking to the plan– you’ve paid off your debt, you’ve got an emergency fund, you’ve even started investing, and you feel so much more at PEACE because you know you can handle whatever comes your way.

You look back at that decision you made TODAY, and you’re so glad that little you decided to take the leap.

Because look at how different your life is now.

More peace.

More options.

More freedom to exist and live your life on your terms.

But what if you didn’t make that choice today.

And you keep doing what you’ve been doing.

You feel like you’re always scrambling.

Like you can never catch up.

Like no matter how much money you make it’s always GONE at the end of the month and you feel like you have nothing to show for it.

And as the months turn into years, you keep telling yourself someday you’ll make that change…

But before you know it… five years have gone by and you’re standing in the same place you were (or worse)… and you wish you had made a different decision..

Today.

On the fence?

That’s a dangerous place to be if you truly want to change your finances.

Here’s the deal. I know the Lazy Money Method works. I’ve witnessed the successes of my clients, making huge money moves they never dreamed possible.

But I want to make this decision easier on you. Let me remove 100% of the risk.

You have a 30-day NO-RISK GUARANTEE to go through the Lazy Money Masters Bootcamp, download everything, and attend the classes. If you do that, try the Lazy Money Masters Bootcamp, and it doesn't work for you? I’ll provide extra coaching to help you through it or issue you a 100% refund if we decide it’s not the right fit for you. That’s how much I believe in this program– I take all the risk away so you’re left with ZERO excuses.

Let's go!

TLDR? Here's the top FAQ's.

Is this live or self-paced?

Why “lazy”? Isn’t lazy a bad thing?

How is the Lazy Money Master Bootcamp Different from other personal finance programs?

How long will it take me to complete the bootcamp?

Is this program good for beginners?

Is this for US students only?

How long will it take to see results?

Will it work for me?

How long will I have access to the bootcamp and recordings?

Praise from our Lazy Community

Disclaimer: Any information presented is not investment advice. I am not a financial advisor and this information is for educational purposes only.

Nothing on this page, any of our associated websites, social media properties, or any of our content or curriculum is a promise or guarantee of future earnings or results. We always recommend using caution and consulting your accountant, lawyer, or professional financial advisor before making any investment decision or before acting on this or any other business or financial information. Basically: talk to professionals before you start investing, recognize that all investments come with an inherent risk, and we don’t guarantee results. Pretty straightforward, right?

Please note any reference to lifetime access also refers to as long as the product is in existence.

Need more info? Check out my terms and conditions here and our privacy policy here.